When preparing for a journey to the Middle East, make sure to gather all necessary details to secure the most cost-effective and suitable itinerary.

The Middle East comprises countries such as Afghanistan, Saudi Arabia, Bahrain, Qatar, United Arab Emirates, Yemen, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Oman, Syria, and Turkey. Known for its ancient civilizations and rich culture, this region has captivated curious minds for centuries. If you are planning a tour that includes these countries, make sure to explore the top travel insurance options available for the Middle East.

The Middle East is a region with stunning natural landscapes and historic cities, but it is essential to book a secure tour to explore it safely and peacefully.

Utilize the internet insurance comparison tool and explore our details to understand the advantages of selecting top insurance providers.

In this article, you will find:

- What is the most secure way to travel to the Middle East?

- How expensive is a secure journey to the Middle East?

- Coupon for discounted safe travels

- Is it necessary to travel safely to the Middle East?

- Why purchase a secure journey to the Middle East?

- What does the travel insurance in the Middle East include?

- How safe travel operates

- How to initiate secure travel

- Types of travel insurance are the different kinds of coverage available for travelers.

- Which travel insurance options are available in the Middle East?

- How to ensure secure transportation when traveling to the Middle East

- Does Safe Travel Middle East provide insurance for coronavirus?

- Top Insurance Companies for the Middle East

- Chip for mobile devices in the Middle East

- Frequently Asked Questions

What is the safest way to travel to the Middle East?

The top travel insurance options for the Middle East are the Affinity 60 Inter Promotional, Travel Care 30 World Basic + COVID19 (EXCLUDING USA), and Intermac 60 Long Stay Inter (excluding USA) Renewal, providing competitive prices and comprehensive coverage.

In addition to hospital medical coverage, legal aid for traffic accidents, and lost baggage insurance, you also receive protection for Covid-19 with the Travel Care 30 World Basic + COVID19 (US EXCEPT) plan.

Next, you will find a compilation of the top available options. Review the benefits of each and assess which one aligns best with your needs.

Affinity 60 Inter Promotion

Medical-hospital expenses up to $60,000 are covered along with $800 for baggage insurance. The policy also includes coverage for sports, dental emergencies, and a refund for pharmaceutical expenses. Check the prices for more details.

Travel Care 30 World Basic + COVID19 (US EXCEPT)

$30,000 coverage for medical-hospital expenses, $1,000 baggage insurance, sports coverage, dental emergency coverage, and pharmaceutical refund are included in the package. Check prices for details.

Intermac 60 Long Stay Inter (excluding USA) RENOVATION

Medical-hospital expenses coverage of $60,000 is provided along with $1,000 in baggage insurance. Additionally, the policy includes coverage for sports, dental emergencies, and reimbursement for pharmaceutical expenses. Pricing information is available.

For more information on top insurance companies, refer to the following details or explore alternative choices on the online comparison tool.

| Insurance | ITA | Universal Assistance | Affinity |

| Plan | Affinity 60 Inter Promotion | Travel Care 30 World Basic + COVID19 (US EXCEPT) | Intermac 60 Long Stay Inter (except USA) RENOVATION |

| Medical and hospital expenses | $60,000 | $30,000 | $60,000 |

| Medical cover for sports | Inside the DMH | $30,000 | Inside the DMH |

| Coverage for pregnant women | Inside the DMH – Until 28 weeks | $30,000 | Inside the DMH – Until 28 weeks |

| Dental cover | $400 | $30,000 | $600 |

| Pharmaceutical cover | $400 (refund) | $1 thousand (refund) | $600 (refund) |

| Medical expenditure by covid-19 | No | $10,000 | No |

| Regression | $30,000 | $50,000 | $30,000 |

| Flight delay costs | $300 (12 hours) | No | $250 (after 12 hours) |

| Assistance in the location of extraviated suitcase | No | Yeah. | Yeah. |

| Damage to the bag | No | No | $ 100 |

| Extraviated baggage insurance | $800 (supply) | $1,000 | $1 thousand (suplement) |

| Legal assistance by traffic accident | $1,000 | Yeah. | No |

| Insurance value | $ 10,91 (per day) | $ 21,32 (per day) | $ 20,37 (per day) |

How expensive is a secure journey to the Middle East?

It is possible to book a secure trip to the Middle East for prices starting at R $ 11 per day. You can use the online insurance comparison tool to view the different available options.

Insurance costs can differ based on the individual’s age and activities planned during the trip.

Insurance is typically affordable and provides peace of mind during travels by handling emergencies.

Everyone purchases insurance for peace of mind, hoping they will never have to use it. However, if the need arises, having this assistance can be beneficial during a crisis.

Explore the secure transportation choices available in the Middle East.

Coupon for discounted safe travel

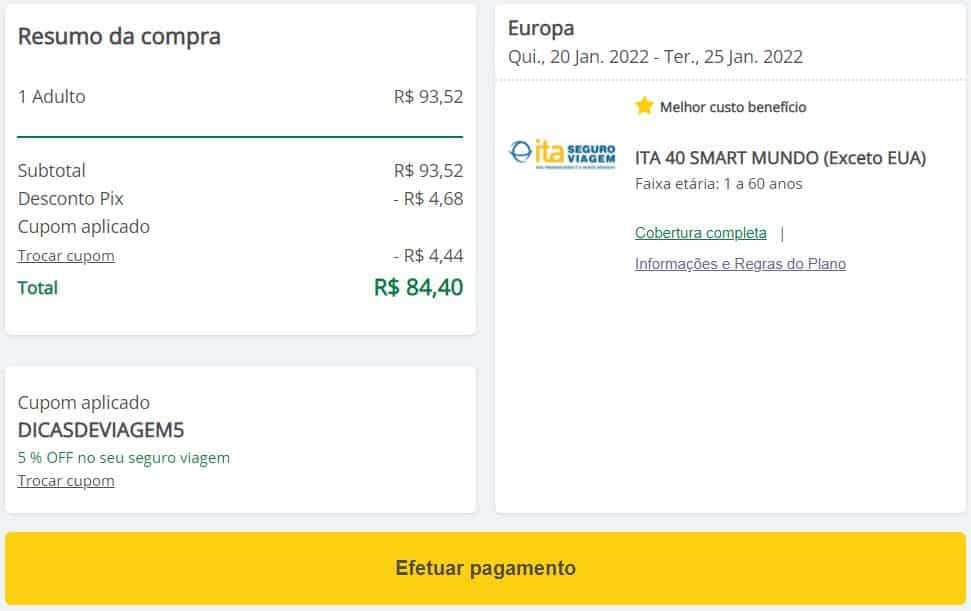

It’s more beneficial to purchase insurance for emergencies during your trip at the most competitive price available. Readers of Travel Tips can apply the coupon code DICASDEVIAGE5 to receive a 5% discount on the total cost. Quite advantageous, isn’t it?

Customers who pay with boleto, pix, or bank transfer can receive an additional 5% discount, which can be combined with other discounts, allowing for savings of up to 10% when booking travel insurance for the Middle East. Additionally, insurance purchases can be paid in installments of up to 12x for added convenience.

- Redeem the DICASDEVIAGE5 coupon code to receive a 5% discount.

- To receive an additional 5% discount and achieve a total of 10% off, make payment via boleto, Pix, or bank transfer.

Is it necessary to travel safely to the Middle East?

Some countries in the Middle East require travelers to have safe travel documentation, while others do not.

It is strongly advised to have travel insurance, as it may be essential in case of medical emergencies during the trip, such as injuring yourself while exploring Petra city ruins.

If your flight is canceled due to reasons such as a sandstorm or an accident on the runway, the travel insurance will provide assistance in Portuguese and compensate you for the incident.

The federal government website offers a guide on the significance of international travel. It is advisable to consult this resource if you are unsure about purchasing insurance or if you want to learn more about safe travel in Syria.

Explore the secure transportation choices in the Middle East.

Why purchase a secure journey to the Middle East?

It is crucial to have travel insurance when visiting the Middle East, as medical expenses can be costly without it, regardless of the destination’s requirements.

Consider the dry climate in the Middle East, which, when combined with the scorching 50°C heat of the Doha desert, can lead to dehydration and sunstroke for those unaccustomed to such extreme weather conditions.

There is no way to anticipate whether such situations will occur to you or not. To prevent such circumstances or other unexpected events during your trip, consider using a reliable travel insurance service. This service offers assistance globally in Portuguese and comprehensive medical coverage.

Many countries in the region, including Palestine, mandate having a travel insurance plan when visiting to prevent potential deportation issues that may arise from not abiding by the local laws.

Safe travel options with great value for money are available, including insurance starting at 11 reais per day. This insurance covers medical care, assistance with lost luggage, medical transfers, and more. Don’t hesitate to secure this essential service for your trip.

Explore the secure travel choices available in the Middle East.

What does the travel insurance include for trips to the Middle East?

Travel insurance typically includes coverage for certain items as a standard practice, like medical emergencies, hospital stays, and compensation for lost luggage. However, there are more extensive plans available that differ depending on the insurance company and the specific policy chosen.

If you encounter traffic issues, you can depend on secure transportation with the assistance of legal support provided by a travel service. The level of coverage depends on the insurance package you select.

Safe travels typically include the most frequent incidents that occur.

- Medical, hospital, or dental care is available around the clock during international trips.

- Repatriation refers to the act of returning someone to their own country.

- Medical transportation

- Transfer of the body and insurance for death during travel

- Accidental total disability while traveling

- Legal and financial support

- Death or severe illness of a relative

You can also rent additional covers to ensure a secure journey.

- Support for the Covid-19 outbreak and other global health crises.

- Travel cancellation policy

- Accidental premature return

- Baggage fees for lost or damaged items

- Radical sports accidents

- Delayed flight

- Expecting a baby

Explore all the secure travel choices available in the Middle East.

How secure travel operates

Travel insurance is a service that ensures travelers receive medical treatment while abroad and offers support in various situations, including legal issues, through assistance or reimbursement.

The support options provided by the online comparison platform offer immediate help during emergencies. This means that you can contact the insurance company for guidance on necessary actions, such as seeking medical attention, without incurring additional costs, as the insurance covers all expenses.

Insurance by reimbursement requires you to pay for medical or professional services upfront and then submit receipts for reimbursement, commonly seen in travel insurance policies linked to credit cards.

Explore the various secure travel choices available in the Middle East.

How to initiate secure journeys

You can contact your insurance company’s phone number for free from any location worldwide to ensure safe travel. The service is available in Portuguese and some insurers offer mobile apps for easier communication.

Always keep your policy number and personal information readily available. Inform the representative of your issue for support in handling the situation, and stay composed to follow instructions and resolve the situation effectively.

Carefully review the travel insurance policy and make sure you understand the details of the plan you have chosen. If you encounter any challenges communicating with the insurance company, don’t hesitate to ask for assistance to ensure you receive the necessary support. Finally, reach out to the company to address any financial matters.

Explore the various secure travel choices available in the Middle East.

Types of travel insurance options.

There are insurance options available for a wide range of travel preferences. Check out our detailed guides for more information on the most common types.

- International travel coverage

- National travel insurance

- Pregnant women should ensure safe travels.

- Safe transportation for older adults

- Sea cruise for safe travel

- Safe multiple journeys

- Safe traveling to multiple destinations

- Annual travel insurance

- Long-term insurance

- Safe exchange of travel

- Student Travel Insurance

Explore the secure transportation choices available in the Middle East.

What types of travel insurance are available in the Middle East?

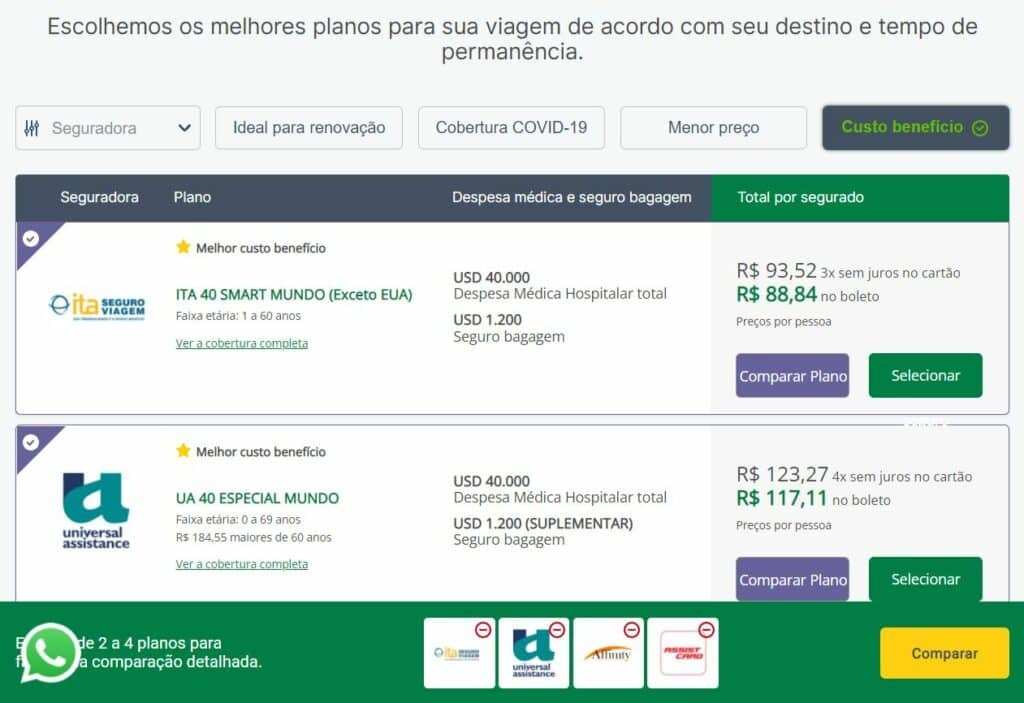

For the best safe travel options in the Middle East, it’s advisable to utilize an online travel insurance comparison tool. Various options are accessible on the website, and we will provide tips to assist you in selecting the most suitable plan.

Place the names of the cities you plan to visit on the pencil tip. Shift your focus to planning and consider all the potential details for the trip.

- What activities do you plan to engage in?

- Do extreme sports like surfing, skydiving, and diving play a role in the plan?

- Are you currently pregnant or is there a possibility that you might be pregnant?

- Is there a possibility that the trip might be called off for any reason?

- Do you want coverage in case your luggage goes missing?

- Some plans provide coverage for seniors aged up to 70 years.

- Is your journey of an extended duration?

- Are you planning to make an exchange?

After conducting this evaluation, you can compare the plans of each insurance provider and assess the coverage values for individual items. The online comparison tool allows you to review up to four plans simultaneously and also identifies the most cost-effective options.

Explore the secure travel choices available in the Middle East.

How to ensure secure travel to the Middle East

Hiring secure travel insurance in the Middle East is easy and can be done online. Promo Insurance is a highly recommended comparator that provides detailed information on top insurance plans to assist you in making a decision.

Choose the desired continent on the homepage, input the departure and arrival dates, provide your name, email, and phone number, then click on “search safe travel.”

You will access a list of available insurances for your destination. Select two to four plans and click on “compare plane”. Then, click the “compare” button at the bottom right of the screen to view the benefits of each insurance side by side for your decision-making and purchase completion.

After being hired, you will be sent your travel insurance policy by email. It is important to keep this document safe, as it contains the terms and conditions of the chosen plan and details on how to contact the insurance company in case of an emergency.

If there is a chance during your trip, you can reach out to the insurance company through phone, WhatsApp, online chat, or email. All contact details are provided in the policy document for easy access.

All insurance providers in Promo Insurance are available 24/7 in Portuguese, ensuring convenient service regardless of your location.

Explore all the secure transportation choices in the Middle East.

Does Safe Travel Middle East provide coverage for coronavirus?

Some travel insurance plans include coverage for medical expenses related to Covid-19, but not all of them do.

When looking for travel insurance that covers Covid-related diagnosis abroad, make sure to choose plans that clearly mention this feature in their title. It’s important to carefully review the policy and address any questions before making a decision.

A useful method to find a secure travel option with Covid-19 coverage is by utilizing an online insurance plan comparison. This way, you can compare the deductibles offered by different insurers and select the one that best suits your needs.

Top Insurance Companies for the Middle East

When looking to travel safely in the Middle East, many people wonder which insurance company to choose. We have a guide that lists the main companies to help you find the best plan.

Explore our articles to discover details about the background of each insurance company, the coverage options they provide, and their reputation on Reclame Here.

- Affection

- Card Watch

- Coris Safe Travel

- Trip Watching

- Ensure a secure journey.

- Grand Theft Auto

- Intermac Support

- Vital Card

- ITA Travel

- Travel Support

- Universal Aid

- My Travel Support

Chip designed for use in the Middle East for mobile devices

You can stay connected to the internet throughout your season in the Middle East with the mobile chip or eSIM designed for this region at reasonable prices. Explore America Chip’s offers and grab a discount coupon.

FAQs

International travel insurance is a service that provides medical assistance and other benefits while traveling abroad in case of accidents or emergencies. It also includes legal aid and coverage for luggage, among other things. Find out more about travel insurance for the Middle East.

The most affordable travel insurance option for the Middle East is the Affinity 60 Inter Promotional, providing great value for travelers. Explore this and other safe travel choices in the Middle East.

Travel insurance is advisable for travelers to certain Middle Eastern countries as it is often required and can be very helpful in unforeseen situations, such as medical emergencies or lost luggage during the trip.

Consider if travel insurance is necessary for entry into your desired country. Failing to have the required documentation could result in deportation. Even if not obligatory, insurance is crucial for unexpected emergencies. Explore more about travel insurance for the Middle East.

The secure travel insurance for the Middle East includes coverage for medical and hospital costs, dental care, repatriation of remains, medical evacuation, and additional customizable features. Explore the available options for more details.

The safe journey insurance does not apply to accidents caused by intoxicated travelers, those using illegal substances, carrying weapons, or behaving recklessly. Make sure to review the policy guidelines to ensure you are covered by the insurance. Find additional details for clarification.

You can cancel a planned trip by contacting the insurance company at least two days before the scheduled departure. Once this deadline has passed, canceling the trip is not an option. For further details, please inquire.

Contact the insurance company to cancel your travel insurance before two days prior to the end of the plan (boarding date) as it will not be possible to cancel it afterwards. Find out more about travel insurance in the Middle East.

Travel insurance policies vary by company. Some policies allow for trip extensions, meaning you can request a new policy to cover your extended stay at the destination. Look for insurance providers that offer this feature.

To prolong your journey safely, you should get in touch with the insurance provider to request an extension of the policy. This must be done at least two days before the policy expires and is dependent on the insurer’s approval. Check for plans that provide continuous coverage.

Safe travel in the Middle East can be cost-effective, with budget-friendly options starting at 11 real per day. Explore further details on insurance for travel in the Middle East.

You can choose to purchase additional coverage for canceled trips, early returns, flight delays, extreme sports, baggage damage, and retrieval costs. Check the specifics of travel insurance plans for the Middle East.

A valid passport is required for entry into Middle Eastern countries, with some countries also requesting additional documents like a vaccination certificate. For specific entry requirements for each country, it is advisable to check the Join Sherpa portal.